On May 1, Aderemi Adeoye retired as the Commissioner of Police in Anambra State. He retired from the position after spending 35 years in service.

During Adeoye’s ceremonial pull-out parade from the Nigeria Police Force on April 27 in Awka, the state capital, he announced that he had already prepared himself for life after retirement.

He made it known that he would be fully taking over the affairs of an investment forum he owned and had founded since 2018.

He then stunned everyone present at the gathering by declaring that the business was worth N20 billion and that in the following 10 years, it would give Aliko Dangote’s entire investment a run for his money.

Interestingly, Adeoye’s “N20 billion investment forum” called Alpha Trust Investment Club (ATIC) has, in the last four years, been the subject of controversy, protests and petitions.

The stakeholders, who are mostly diaspora-based Nigerians, have accused the former CP of running a Ponzi scheme and defrauding them.

They raised concerns about a lack of accountability and not having a proper structure in place.

They also accused Adeoye of consistent and gross abuse of power, intimidation, arbitrary punitive actions against members, negligence of duty and failure to adhere to regulatory requirements.

A MEMBER WHO TOOK A LOAN FROM ATIC

Mahmud Bernard (not real name), one of ATIC’s diaspora investors, spoke to FIJ about how he once took a loan from the club and none of its principal officers bothered to demand he pay it back when repayment was due.

“In 2017, we got to hear of how Adeoye had been arresting fraudulent people, and we found it commendable,” said Bernard.

“He then later formed an online investment platform or cooperative society called ATIC in 2018. I subsequently joined the platform between 2020 and 2021.

“Everything started on Facebook, and most of the members were mostly Nigerians living in the US, Canada, UK, Australia, and so on.

“It was a cooperative society where people contributed money and took loans that came with very good and low interest rates.

“Adeoye told us, at the time, that the money we contributed would be used to invest in real estates. He added that the profit realised from the business would then be shared at the end of every year, and according to the seize of your investment shares.”

Bernard said he became quite willing to invest in the business when he considered the fact that Adeoye seemed like a police officer who could be trusted.

“I immediately committed N1.2 million to it,” said Bernard.

“When I joined, I was told that a unit share sold for N3. I then bought 400,000 shares and paid Adeoye N1.2 million. I left the investment the way it was without touching anything.

“Two years later, however, ATIC reached out to me, requesting that I pay my membership fees so I could get my dividend for the year. I paid the N12,000 and I got a dividend payment of N150,000 that year.”

‘PONZI VIBES‘

Bernard told FIJ that he subsequently took a loan from ATIC because he needed to resolve a financial obligation urgently.

“I then borrowed N900,000 at an interest rate of one percent every month and for nine months from ATIC,” said Bernard.

“I was told I could not borrow more than the stock I had on the platform, and as of that time, each of my shares had appreciated to N6. This also meant that I had a total value share of N2.4 million.

“It was after I borrowed the N900,000 that I eventually realised that the society was somewhat a Ponzi scheme. After nine months, I didn’t immediately have the money to pay back what I owed and was expecting someone from the organisation to reach out to me and remind me of the payment.

“Shockingly, no one did. No one whatsoever!

“After an additional two months, I had the money ready and then reached out to ATIC. I told them I needed to pay a loan and asked to know the penalty for late payment.

“At that point, I was asked to talk to the financial secretary. When I spoke with the financial secretary, she simply and surprisingly asked me to go and pay the N900,000 I owed without any late payment fee or fine!

“That particular incident then got me wondering what the society was all about.

“How can you just ask me to go and pay the N900,000 I owed without asking me to pay interests or any penalty fee? The event simply showed me that the organisation had no structure in place. It also showed me that the appropriate platform for accountability had not been created.”

‘EVERYTHING IS DONE VIA FACEBOOK’

A US-based ATIC member, who asked not to be named, also told FIJ that the club carried out almost all of its activities on Facebook only.

“Every major event the group carries out is via Facebook, no website or any other formal platform whatsoever,” the member said.

“At a point, I thought it was going to be a formal organisation where everything would be done in an appropriate manner. The thinking was that ATIC would employ a few people so that members’ inquiries could be responded to faster.

“After I saw these things, I knew something was wrong. I was supposed to have pulled my money out, but I didn’t know what made me leave my money there.

“That was how things were until August 2023, when I emailed Adeoye to say I needed to exit the group. I also told him I didn’t feel ATIC was a well set-up organisation.

“At that point, my stock had already risen in terms of value, but he responded to me by saying that the only way I could get my money back was if I agreed to receive the exact amount I paid for all of those monetary commitments I had with the group when I initially started the investment.

“The mistake I made was not collecting what he offered me at the time. I rejected it, saying that the shares had appreciated and that it was only right that I got paid the current value that my stock was then worth.

“That was how he (Adeoye) went silent on me.”

HIGH-HANDEDNESS AND CRIPPLING CRYPTO BUSINESS

Marilyn Shugaba (not real name), a UK-based investor, told FIJ that some members who invested heavily in the club had been demanding that an audit be carried out but they would not get any response from Adeoye.

“In November 2023, I discovered that some elderly members of the club, who had greater shares, like N50 million or N100 million, had been asking for an audit and requesting for structures to be put in place, but they didn’t get any response from him (Adeoye),” said Shugaba.

“That’s pure high-handedness!

“The initial plan when he started the club was for him to invest in landed properties with the contributions we made and then share profits at the end of the year.

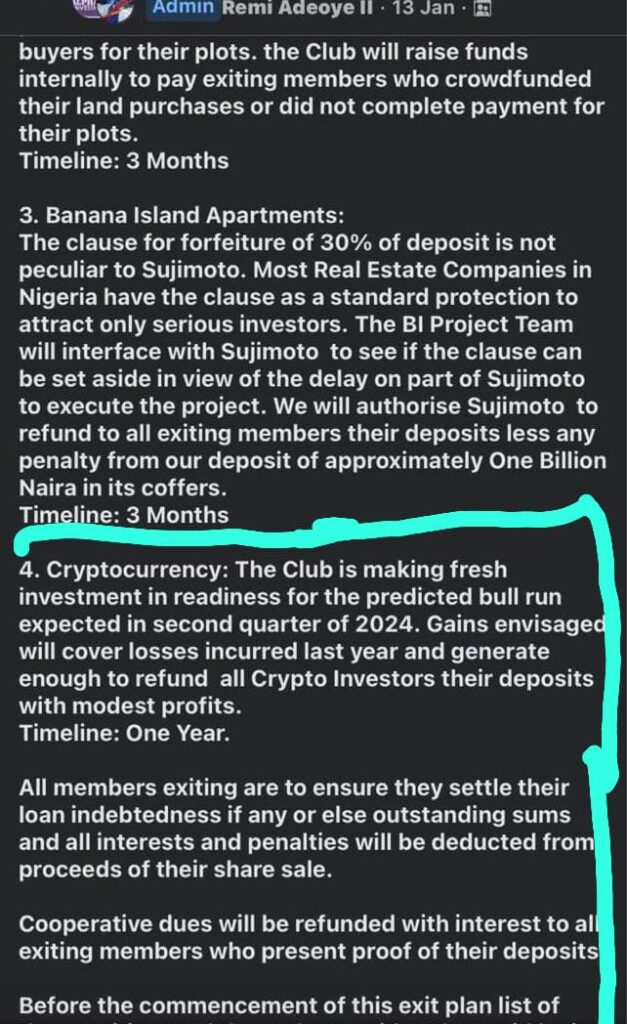

“All of a sudden, we heard he had ventured into crypto business without carrying members along. When members of ATIC’s board of trustees also started asking him questions, he immediately changed them to advisory board of trustees.

“To add to this, he also opened different accounts in the name of ATIC and was controlling them alone. No one has been able to have a glimpse of what the financial books of the cooperative look like since it was created.

“I have it on good authority that he lost a lot of money doing crypto business. The sad part is that he single-handedly went into the business without people’s consent. What we were told from inception was that he would be doing property business with our monies.

“What makes it a Ponzi scheme is that he started spending the club’s money in an insecure business, thinking the money would continue to come to him like water rushing from a tap.

“Now, he has refused to pay people their monies back. In fact, we have written a petition to Kayode Egbetokun, the IG of police. He did a multimillion-naira business with Fujimoto and that has not even yielded any fruit. He cannot account for it.

“I am sure the contribution money we are talking about is worth up to N20 billion. He is simply using Peter to pay Paul. He did agro-allied business without carrying anyone along.

“Till now, no one knows what has happened to it. We want justice on this. People’s life savings are on this. We are talking about a club that has over 1,400 members. The least you can use to join the club is N50,000.”

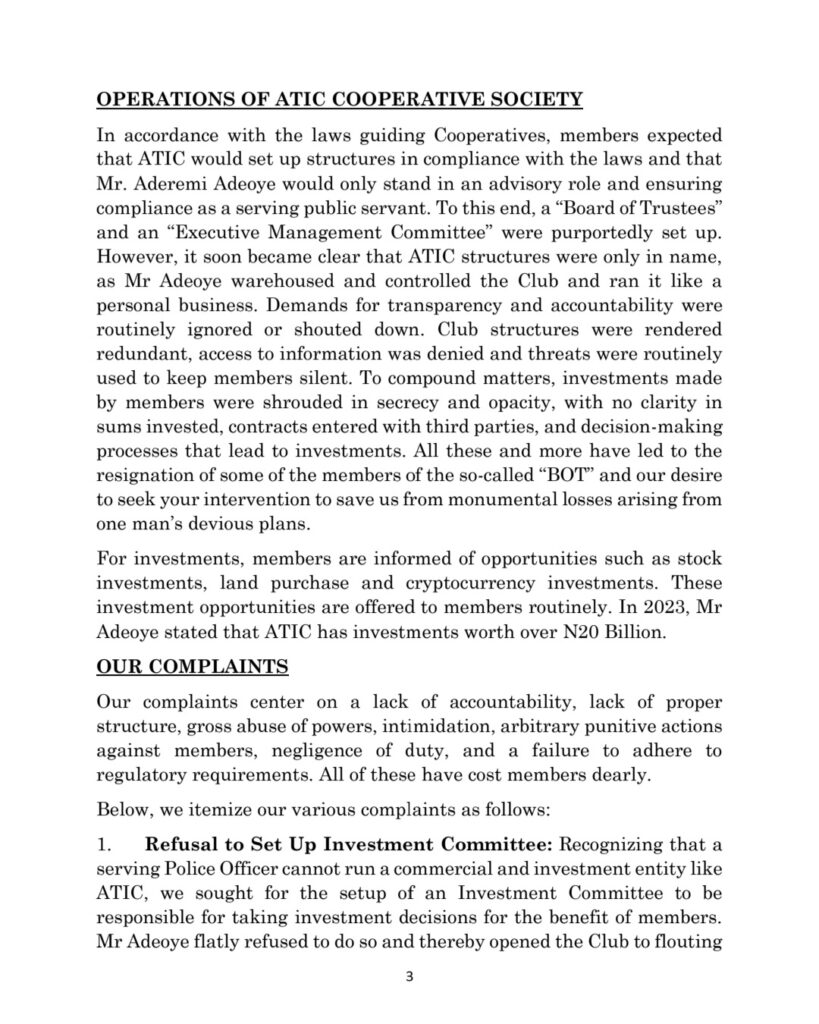

THE PETITION WRITTEN AGAINST ADEOYE

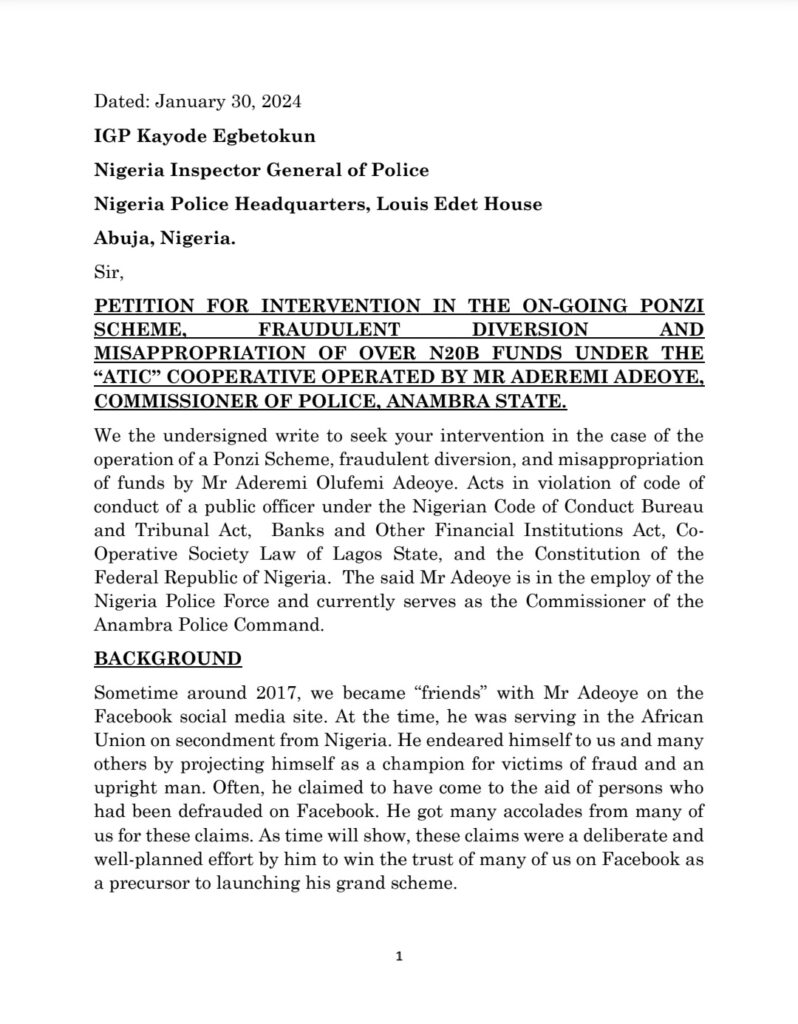

On January 30, some elderly members of the club believed to have invested a joint sum of over N500 million in the society wrote Kayode Egbetokun, the Inspector General of Police (IGP), seeking his intervention on the matter.

Adeoye had before then referred to this particular set of members as “renegades”.

In the 12-page petition, the 33 members who co-signed it accused Adeoye of refusing to set up an investment committee, changing the status of board of trustee members to an advisory role, removal of members from the club arbitrarily, registering club name and opening bank accounts without seeking approval and refusing to enact a constitution.

Other accusations listed in the petition included his refusal to audit the club’s account, operating a Ponzi scheme, failure to provide the number of issued shares, failure to set up a website, failure to set up a physical office, lack of proper record-keeping and inflation of land prices.

He was also accused of bullying BoT members when they would not stop asking questions about their investments.

The members then went on to request that Adeoye, who was still in active service at the time, be compelled to consent to the auditing of all nine collection accounts he had been using for the club’s investments. This was to be done after a restriction had been placed on the accounts. They added that Egbetokun appoint a custodian to pay them the invested funds Adeoye had failed to make available to them with interest.

FIJ SENT AN EMAIL TO ADEOYE IN FEBRUARY

On February 12, FIJ sent an email to Adeoye for comments on the allegations made by ATIC investors, and he responded by stating the following:

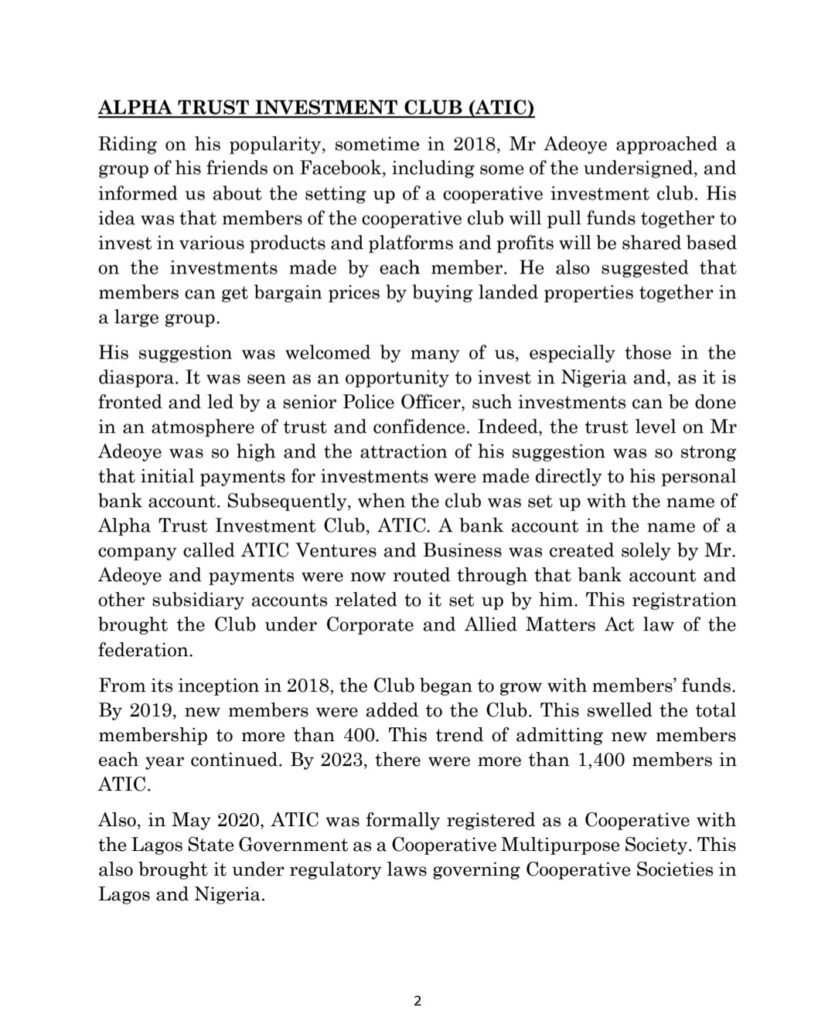

“I am Commissioner of Police Aderemi Adeoye in charge of Anambra State Command. I formed ATIC in 2018 while serving as Police Coordinator for African Union Commission in Addis Ababa, Ethiopia. It was an informal group of friends on Facebook which decided to invest in stocks on the Nigerian Stock Exchange. We later veered into Real Estate.

READ ALSO: ‘Soldiers’ Killed Driver of 2022 Toyota Corolla and Stole the Car. A WhatsApp VN Exposed Them

“None of the petitioners started with us. They joined from 2020 after we have recorded some significant progress. I did not invite anyone to join. Those who joined did so of their own volition.

“We invest in stocks and real estate mainly and we have built a formidable fortune for our members numbering over 1400. It might interest you to note that those petitioning were members who were expelled from the Cooperative for Gross Misconduct, Disorderly Behaviour, Issuing criminal threats, criminal defamation and sundry other infarctions.

“Upon expulsion they were invited to the Cooperative Exit Lounge for settlement of their investment claims but they have refused to accept the invitation. There are other members numbering over 70 who are exiting the Club due to economic downturn and all of them have accepted the invitation to the Lounge and their claims are being processed for settlement.

“We are an investment group and we are all volunteers. Every receipt of transaction we make were always posted in our Lounge on Facebook for members information but majority of these petitioners show scant interest in what we do. They only come around once a year to collect dividend and go.

“Properties we bought are bought jointly in the name of the cooperative. So there are no individual documents. However we have an internal land auction platform where members sell to other members plots they wish to relinquish. The Cooperative has plans to sell those that have become very expensive to the public and credit members accounts with proceeds.

“For expelled members, we are writing to developers we bought from to carve out of our bulk purchase and allocate to the expelled members plots they own in their own names. The expelled members are to pay directly to the developers for change of name on the documents since the original name was that of the cooperative.

“We have always been accountable and transparent to our members. There is no abuse of power. We have a Board of Trustees and an Executive Management Team in place that run the Cooperative. It is just that I created all the avenue of incomes that we share as dividend on annual basis. We have always paid dividend to our members every year without fail since 2019.

“For seamless settlement of claims you may wish to advise the petitioners to accept the invitation to the Cooperative EXIT Lounge to enable us process their claims for settlement. We are already on it with other members who are leaving.”

ADEOYE DID NOT PAY EXIT LOUNGE MEMBERS AFTER RESPONSE TO FIJ

Ranti Uthman (not real name), another affected investor, told FIJ that Adeoye had still not paid all the members he put in the exit lounge despite his many promises.

“I joined the cooperative in 2022,” Uthman said.

“When the crisis started, I told him (Adeoye) I would like the ATIC’s finances to be audited, and he automatically put my name in the special exit group he had created for those he was planning to expel.

“He saw me as a trouble maker. This was after I had invested N10 million in the cooperative society.

“After forcing us to migrate to the exit lounge, he said he would pay us back our money. Since January, however, and till we speak, no one has received a dime from him.”

READ ALSO: How Abeokuta Farmer Kazeem Dosumu Single-Handedly Built a Bridge for His Community

Uthman added that Adeoye never sent any evidence in form of financial documents to the group as well.

“After forcing us into that exit group, he has continued to give us excuses as to when we will be paid our money,” Uthman said.

“Till we speak, he has not made any move to repay us. I can confidently tell you that he has not paid anyone he placed in the exit group.

“And he is still claiming the cooperative society is worth N20 billion. He is the one single-handedly managing the financial affairs of the club. He has also failed to anyone the club’s books, just for us to know if our contributions have been put to good use. He is the sole signatory to all the cooperatives’ accounts.

“I have about N10 million with the society. And he is always quick to make everybody know that he is a senior-ranking officer in the police.”

WHAT WE KNOW SO FAR

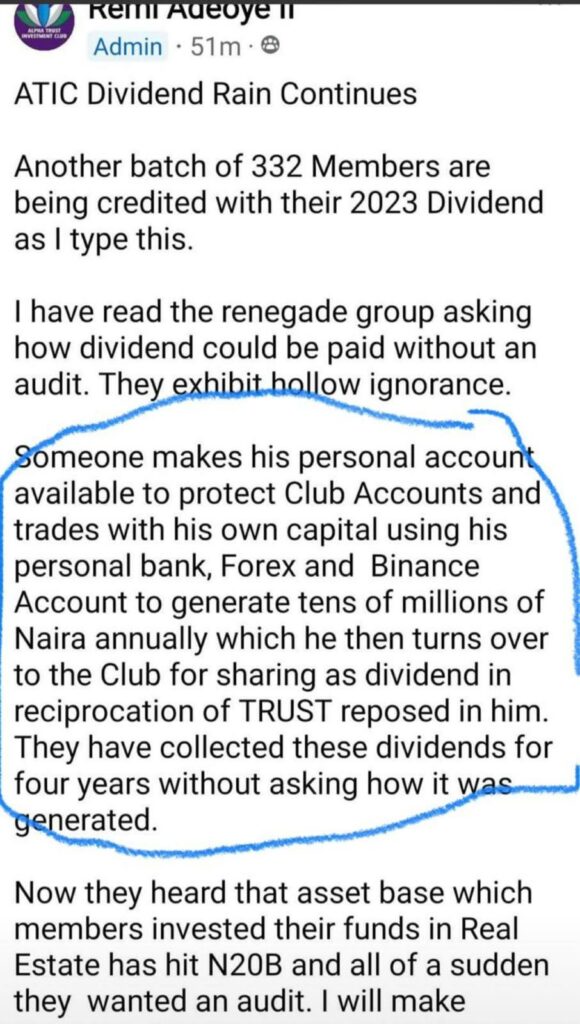

In a recent post, and on ATIC’s Facebook page, Adeoye stated that “he had made his personal account available in an attempt to protect club accounts”.

“ATIC dividend rain continues,” he wrote in the post.

“Another batch of 332 members are being credited with their 2023 dividends as I type this.

“I have read the renegade group asking how dividend could be paid without an audit. They exhibit hollow ignorance.

“Someone makes his personal account available to protect club accounts and trades with his own capital using his personal bank, forex and Binance account to generate tens of millions of naira annually which he then turns over to the club for sharing as dividend in reciprocation of trust reposed in him.

“They have collected these dividends for four years without asking how it was generated.

“Now, they have heard that asset base which members invested their funds in real estate has hit N20 billion and all of a sudden they wanted [sic] an audit.”

The above comments clearly revealed that Adeoye had commingled funds. This means he mixed “his personal funds” with those of ATIC’s investors and that automatically makes accountability difficult.

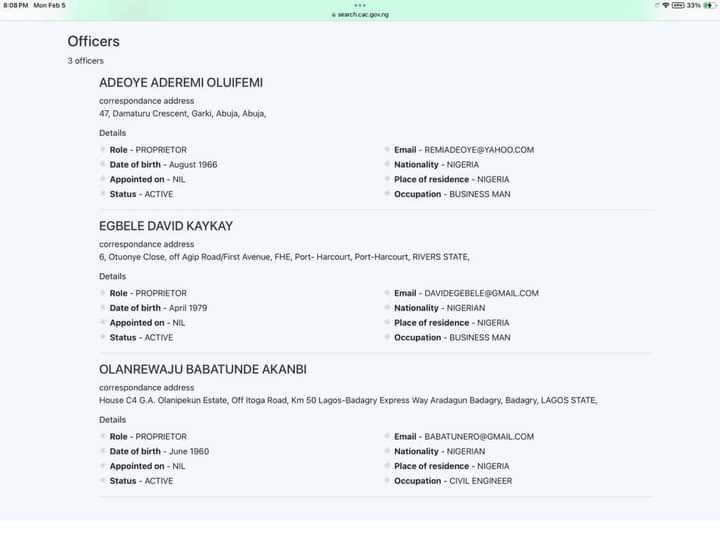

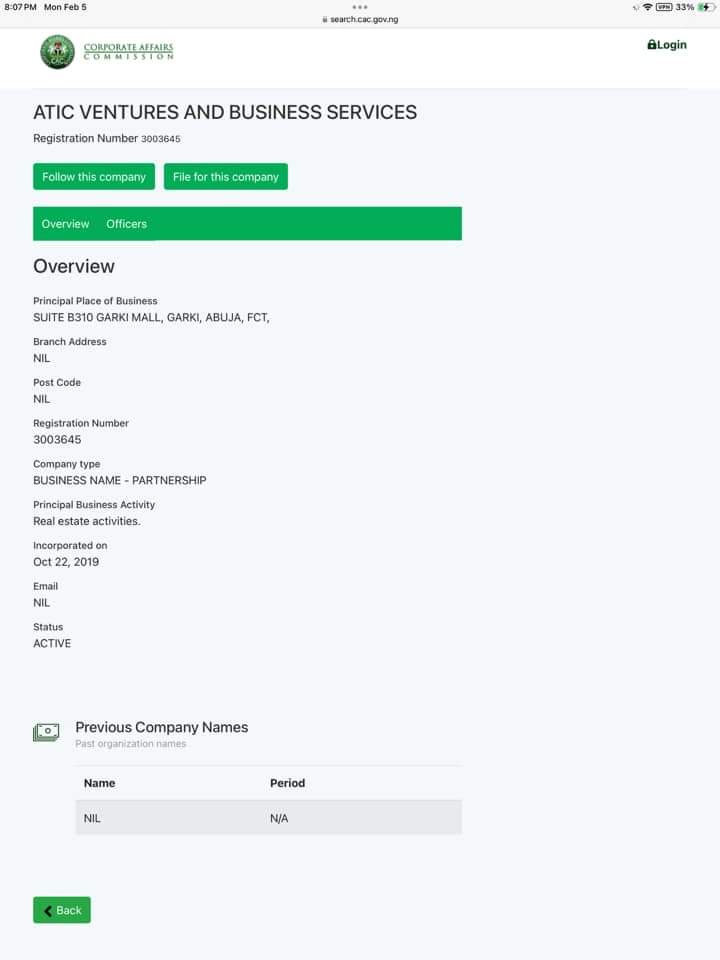

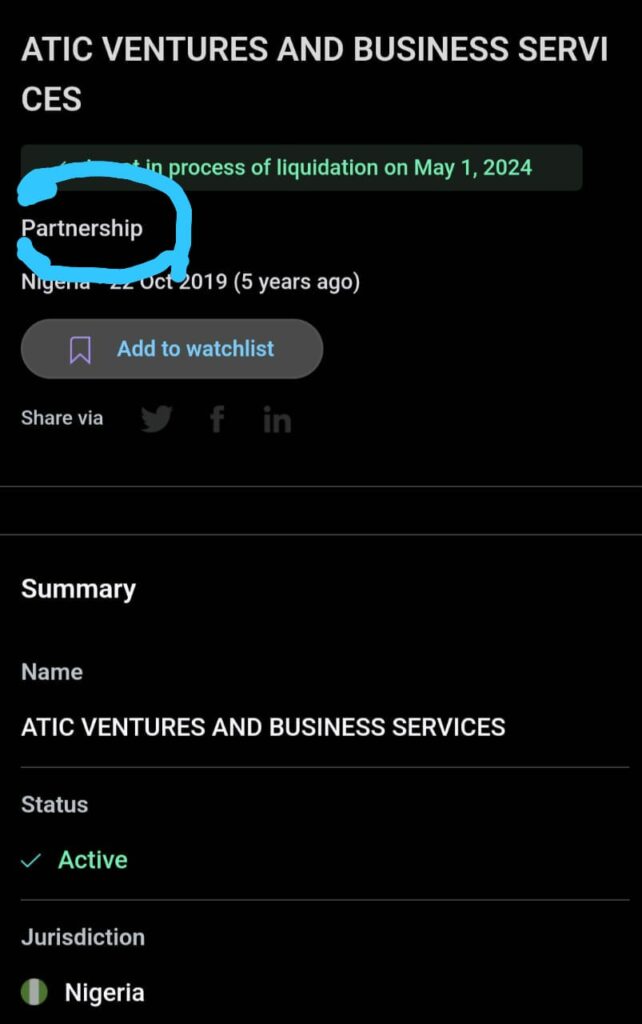

Alpha Trust Investment Club, despite being worth N20 billion, is not listed with the Corporate Affairs Commission (CAC).

Instead, Adeoye had the enterprise ATIC Ventures and Business Services registered on the CAC portal in 2019.

The entity was also described as a partnership and not a cooperative society, as advertised to its contributors at the very beginning.

It was also stated on the CAC portal that ATIC Ventures and Business Services headquarters was located at Suite B310 Garki Mall, Abuja.

FIJ, however, found that ATIC Ventures and Business Services is not headquartered there. As a matter of fact, it is not situated anywhere in Nigeria.

ATIC Ventures and Business Services was also listed as an entity that specialises in real estate activities, not crypto or forex trading.

On Friday morning, and while entertaining questions on Arise TV’s The Morning Show, Adeoye was asked a question on when an audit would be carried out on ATIC’s finances.

He said, “About our books, we are only answerable to our members, BoT and subscribers. Except you have a court order, you cannot get access to our books.”

THE CODE OF CONDUCT BUREAU AND TRIBUNAL ACT

The matter between Adeoye and the aggrieved contributors would later lead to a question on whether there are regulations within the police that frown at a serving officer establishing and running a business venture like ATIC.

The Code of Conduct Bureau and Tribunal Act answers such questions:

“Without prejudice to the generality of section 5 of this Act, a public officer shall not –

(a) receive or be paid the emoluments of any public office at the same time as he receives or is paid the emoluments of any other public office; or

(b) except where he is not employed on full-time basis, engage or participate in the management or running of any private business, profession or trade; but nothing in this paragraph shall prevent a public officer from engaging in farming or participating in the management or running of any farm.

Adeoye started ATIC in 2018 as a serving senior police officer. During the period, the cooperative was not run as an outfit that provided agricultural or farming services.

Instead, ATIC’s recent activities and affairs have earned Adeoye the name “Billionaire Cop”.