By Roman Oseghale

________Why we must look at data before reaching a logical conclusion!!!…….

Data allow your political judgements to be based on facts, to the extent that numbers describe realities. ——-Hans Rosling

There are 3 preliminary fundamental factors investors look at before investing in an economy, if these factors are good then they move to the next phase of country assessments before investing their funds… these factors are:

- Stability (Political, Regional, and State)

- Return on Investments (ROI)

- The country’s balance sheet

If these factors are good, investors will flood your economy, but if these factors are not in good order, the investors will either not come in or those already in the country will start divesting their investments…..

In the book “The End of Poverty” by Prof. Jeffrey D. Sachs the renowned Harvard Trained Professor of Economics and Director of The Earth Institute, and Professor at Columbia University describes and lays out the 8 factors that can push a country into what is called “Poverty Trap”……….a situation where it is almost impossible to get the citizens of the country out of poverty. Why countries fail to achieve economic growth and how something as complex as a society’s economic system has too many parts and why you cannot focus on one part alone, and how problems can occur from one part and spread to different parts of the economic system bringing the economy to a halt.

He goes on to explain that just like Clinical Medicine where a simple convulsion can lead to brain problem, or heart problems which can spread to the liver, kidneys, and the rest of the organs of the body and may eventually kill the patient……..in Clinical Medicine, doctors sit a patient down to examine the cause of an illness by taking comprehensive qualitative data like history of the illness in the family, what kind of diet the patient eats, past injuries, etc…….these data are collated and transformed into a quantitative data to help trace the PAST source of the illness, how it affects the PRESENT and should be treated, and how it can be averted in the FUTURE to help the patient live a normal life.

Like Clinical Medicine, Professor Sachs describes Clinical Economics as how to diagnose and trace the cause of every economic problem by looking at all the components and how these components have interacted with one another from the past and how they have brought the economy to its present state. To understand Nigeria’s present economic challenges we will look at the major contributing factors from year 1999 to 2016.

Obasanjo, External Earnings, Foreign Reserve, Excess Crude oil Account, and Foreign Direct Investments……..

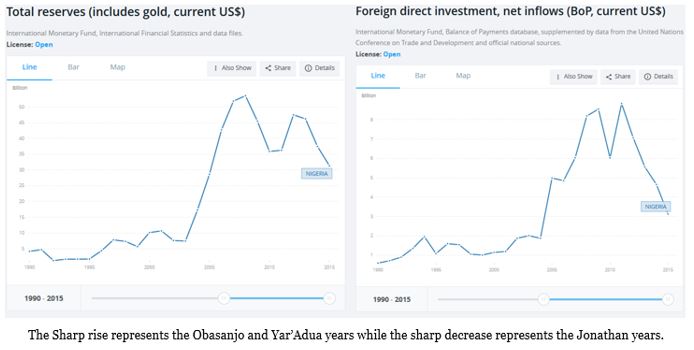

Between 1999 and 2008, Foreign Reserve increased by USD$47.75 billion (845%) and Foreign Direct Investments net yearly inflow increased by a marginal of USD$7.2 billion (716%).

When President Obasanjo took over office in May 1999, Foreign Reserve was about USD$4 billion, FDI into Nigeria that year was USD$1 billion, and Crude oil price as at May 1999 was USD$24.5. On average, Obasanjo sold crude oil in 1999 for USD$32, his first 4 years in office Obasanjo sold crude oil at an average of USD$46, and his second term he sold crude at an average of USD$70.6, and overall 8 years at an average of USD$58…….Obasanjo ensured political, regional, and state security.

Obasanjo also had the advantage of privatising most government agencies and companies, BPE was said to have privatised over 400 companies and agencies, and the administration racked in billions of dollars from both non-refundable bidding prices and outright purchase. Obasanjo also had the opportunity of launching the innovation of that time “GSM”…..this also brought in billions for the government…..Obasanjo knowing the essence and strategic importance of an increased foreign reserve decided to save most of the funds from both crude sales and the privatisation exercise. Between the Foreign reserve and Excess Crude Account (ECA) Nigeria had USD$102 billion.

Having a large foreign currency reserve is an important indicator of a country’s ability to repay foreign debt, for currency defence, and also used for credit ratings which ultimately attracts Foreign Investors into the country…….and as Nigeria foreign reserve grew with Obasanjo paying off both the London and Paris Club debts, the increasing foreign reserve was able to defend the local currency (Naira) and the naira started to appreciate, when Prof. Soludo became governor of Central Bank in 2004, Naira was N147 to a dollar and by the time he was leaving in 2009, the Naira had appreciated to N117 to a dollar.

What this means is that if an investor brought in USD$500 million in 2004, by 2009 the USD$500 million will be worth USD$628.3 million (500m x 147/117)……..a whopping USD$128.3 million in 5 years just by investing in the economy, an average of USD$25.66 million per year in profits through the currency (Naira) appreciating……..this is not taking into account profits generated through operations in the country.

“Nigeria reached a deal last October with the Paris Club, which includes the United States, Germany, France and other wealthy nations, that allowed it to pay off about $30 billion in accumulated debt for about $12 billion, an overall discount of about 60 percent”……..The New York Times April 22, 2006.

In 2006, seeing Nigeria’s economic progress Standard and Poor’s, Fitch, and Moody’s started credit ratings on Nigeria, in general, a credit rating is used by sovereign wealth funds, pension funds and other investors to gauge the credit worthiness of a country thus having a big impact on the country’s borrowing costs and investments through FDI’s, Nigeria’s S&P credit rating was BB- (stable outlook), by August 2009 S&P moved Nigeria up to B+ (Stable outlook)……..Why?……..With a reduced external debt, increased foreign reserve and external earning of 43% of a GDP of USD$169.5 billion, Nigeria’s balance sheet was looking good, and investors flooded Nigeria. What this means is that we had huge savings (assets), our income was good (revenue), and most of our debt (liabilities) paid off.

“The big three of the credit rating industry, S&P, Moody’s, and Fitch holds 94% of the credit rating market share. S&P includes the factors of the political score, economic score, external score, fiscal score, and monetary score. These broad factors can be classified into two categories and they are political and economic profile, flexibility and performance profile. In terms of Moody’s evaluation process, it includes four factors. They are an economic strength, institutional strength, fiscal strength, and susceptibility to the event of risk. The Fitch’s process for evaluation is quite similar to that of other two”…….Alpha Rating.

“Earlier this year, two credit-rating agencies rated Nigeria’s credit as BB-, which is below investment grade but puts it on a par with developing nations like Turkey, Ukraine and Brazil”…The New York Times April 22, 2006.

At the end of 1999, Nigeria’s Foreign Reserve was USD$5.65 billion and Foreign Direct Investment Net Inflow was USD$1 billion, by year 2004 and Obasanjo’s diversification of the economy Foreign Reserve increased to USD$17.3 billion and Foreign Direct Investment inflow was USD$1.87 billion. By 2005, as Foreign reserve increased to USD$28.6 billion, foreign direct investments inflow was USD$4.98 billion, by 2007 foreign reserved reached USD$52 billion and Foreign direct investments inflow reached USD$6.035 billion……and by 2008 with a foreign reserve of USD$54 billion, Foreign Direct Investment reached USD$8.2 billion. Between 1999 and 2008, Foreign Reserve increased by USD$47.75 billion (845%) and Foreign Direct Investments net yearly inflow increased by a marginal of USD$7.2 billion (716%).

Explanation in Layman’s Term: Suppose you want to invest in a company, you look at the balance sheet…..the assets which is equity plus the liability…….if total assets exceeds total liability (debt) then you know the business is solvent, it can pay its debts, if total assets is increasing and liability decreasing, then you know it’s a good company, but if total liability (debt) is increasing and assets reducing then it is not a good company to invest in.

Or if you want to loan money from the bank…..what the banks does is calculate your net worth, your assets plus your liabilities……this will give the bank a total of what you are worth, but it does not stop there….the bank also looks at your income to see if you are able to service your loan….once your assets exceeds your liability with a good margin and you have a good income to service your debt the bank approves the loan…..this is how the credit score of an individual is calculated.

This was exactly what Obasanjo did with the economy……..he increased Nigeria’s assets (Foreign Reserve), reduced our debt (London and Paris Club debt), and our external earnings (Income) increased as a percentage of our GDP……..this increased our credit ratings and investors flooded the country. This basically showed the investors that the economy was properly managed and it boosted their confidence.

Jonathan Administration!..…Data Shows the FDI had been shrinking since beginning of 2012, and the Economy was in Steady Decline with companies moving their funds out.

During the late President Musa Yar’Adua’s tenure in office before his death…..in fact Obasanjo left USD$52 billion in the Foreign Reserve, it was Yar’Adua who increased it to the all-time high of USD$62 billion, what Yar’Adua did was to follow the economic policies of Obasanjo….which boosted investors’ confidence.

When Jonathan assumed office he started out by doing the direct opposite of what Obasanjo had done, the direct opposite of economics……..he was decreasing the Assets (Foreign Reserve), increasing debt (Liabilities) and at the same time External Revenue (Revenue Income) was decreasing. This greatly affected the economy…..most people failed to look at data and hence don’t know this fact……those who support and commend his administration support out of ignorance…..

From 2009, the Jonathan Administration should have seen the warning sign, in fact the warning signs were there but greed they say blinds everyman from reality, as the US produced more oil so did they cut down on import and Nigeria being a monolithic economy that depends on about 90% of its external earning from crude started to take the hit…

The blame has consistently been heaped on President Buhari and his body language, with many claiming that the President brought the economy of the country to a standstill by causing investors to leave the country……but a critical look at the data says otherwise…..Like Investments banking which follows the flow of liquid cash, Foreign Direct Investments follows regional or a country’s stability, Return on Investments, and a country’s good balance sheet.

Amidst the growing believe that the economy was healthy, the economy had been in a steady decline since 2011, Foreign Direct Investment had been reducing, and most of the companies must have been following the country’s balance sheet and security situations, and in-house economists and consultants warning of the dangers ahead.

By 2010 when Jonathan became President, our External earnings as a percentage of GDP had started falling as compared to the size of the GDP…….25% of the GDP….it meant that our External Earning was not growing but our GDP was increasing. Nigeria at this point still enjoyed the S&P rating which put the credit rating of the country at B+ (Positive outlook) till December, 2011.

While crude was sold at an average price of USD$110 per barrel, the depletion of the foreign reserve had not started taking its toll on the country’s balance sheet at this point…..and ironically this was the same time HRH Lamido Sanusi Lamido, then governor of Central Bank started raising the alarm over the long term implications of depleting the foreign reserve. Still enjoying the ratings, FDI reached all time high of USD$8.841 billion in 2011….by this time regional and state security started breaking down.

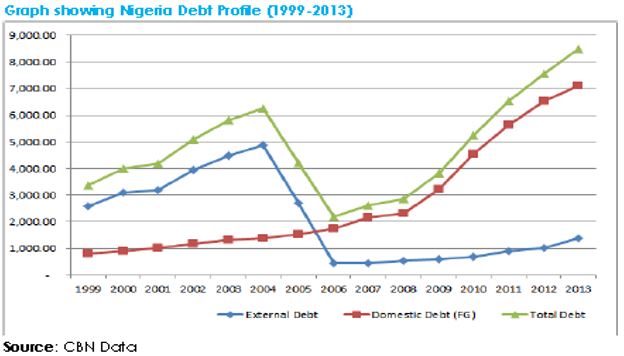

All that was to change at the beginning of 2012, the depletion of the foreign reserve started taking its toll on the balance sheet of the country coupled with the fact that debt was increasing, by the end of Jonathan’s tenure his administration had added USD$21.8 billion, as debt increased, foreign reserve decreasing, and external earning decreasing, investors started becoming weary of investing in the country as confidence declined in the market.

By 2012, S&P had downgraded Nigeria’s credit ratings to BB- (Negative), this grading according to the Credit ratings is below investment grade, and as soon as they did this investors’ confidence eroded from the market, this rating remained till March 2014 when Nigeria was now placed on BB- (Negative watch outlook) what this means is that they had to monitor the economy……by this period external earnings had reduced to 18% of new GDP…….Nigeria’s credit rating remained in BB- (Negative) till February 2015, it wasn’t until March 2015 before it moved to B+ (Stable outlook) just days to the elections…….while the dollars that should have been saved found their ways into the economy expanding it, making it look as if it was good, the opposite was happening to the balance sheet of the country, people spent like there was no tomorrow, but refused to understand the long term economic consequences.

Ironically……this was the same time Nigerian’s were celebrating Jonathan, but the implications was to follow……….in 2012 as Nigeria was getting ready to rebase its economy showcasing that it was now the biggest economy in Africa……investors were staying away, by 2012 FDI had reduced from a yearly inflow of USD$8.841 billion in 2011 down to USD$7 billion in 2012……by 2013 FDI net inflow had further reduced to USD$5.6 billion, by 2014 with a foreign reserve of USD$37.5 billion…..FDI net inflow further reduced to USD$4.6 billion, and by 2015 with a foreign reserve of USD$31.3 billion, FDI net inflow had reduced to USD$3.1 billion. All time low since 2004.

It was simple!!!!!!!…….investors had seen it coming……Foreign Reserve was being depleted, debt was increasing, external earnings was decreasing……the US which is Nigeria’s biggest oil customer was now producing oil and buying less quantities from Nigeria, and above all, Nigeria as a monolithic economy where oil accounts for about 90% of its external earning…….if crude price should fall they will lose the value of their investments. From 2009 to 2015, Nigeria’s foreign reserve had reduced by about USD$31 billion (50%), ECA reduced by about 95% and Foreign Direct Investments net inflows reduced by a marginal of USD$5.712 billion (65%)……companies had seen it coming and have been moving their funds since 2013……

On February 23, 2015, before the presidential elections the Vanguard Newspapers reported “Capital flight: Economy hard hit by USD$22.1 billion outflow in 5 weeks”….in a survey made by CBN, the apex bank confirmed that USD$22.1 billion went out of the economy in 5 weeks with an average of USD$4.5 billion per week. USD$3.083 billion went out the week ending 31st July, 2014, USD$4.2 billion the week ending 30th, August, USD$4.1 billion week ending 30th of September, 2014, USD$5.29 billion week ending 31st October, 2014, and USD$5.35 billion week ending November 30th, 2014.

“A great deal of intelligence can be invested in ignorance when the need for illusion is deep”……Saul Bellow

Nigerians must not invest a great deal of intelligence in ignorance because of the dislike they have for the president who have stood his ground that it is no longer business as usual…..it is tough, but Nigerians must understand that the economy cannot collapse in one month….it is a series of systematic failure over a period of time. Those who saw the problems in its anticipatory stage, the reactive stage and did nothing before it got to the crisis state are those that did the damage.

For those blaming the presidents body language and policies…..data don’t lie, foreign companies spend hundreds of millions of dollars annually studying market, industry and world business trends before investing, those who have already invested perform either quarterly, bi-annual, or annual review of whatever country they are operating considering these factors, and if they perceive any danger, they divest their funds and move the funds out while they may still remain in the economy for skeletal operations.

Analysing Nigeria’s Balance Sheet and its Credit Ratings……..2006 to 2015

As President, Obasanjo managed the economy with a good balance sheet for the country…..this was what attracted FDI’s into Nigeria. Between 2008 and 2009…..we had USD$102 billion between the Foreign Reserve and the Excess Crude Oil Account (ECA), this represented our assets and was also our Equity. Our liabilities (debt) had being reduced and our External Earnings (Revenue Income) as at 2006 was 43% of our GDP. What this means is that our DEBT TO EQUITY RATIO was low, our Equity superseded our debt, and this was why Nigeria was moved from BB- to B+ in 2009, this was a good balance sheet for investors.

By 2010 the depletion of the external reserve started, and with sales of Crude oil averaging USD$110 per barrel a year, and nothing added to the External reserve, by 2012 Jonathan’s government had started borrowing which further compounded our problems and the country’s balance sheet……by the time Jonathan was leaving External Reserve (Assets) had been reduced to USD$31 billion, Excess Crude Oil Account (Assets) empty, he had increased Nigeria’s debt (Liability) as confirmed by Okonjo-Iweala by USD$21.8 billion to reach USD$USD$63.7 billion, External Earnings as Percentage of GDP (Revenue Income) was 18% of GDP……..which meant that our liquid assets had been reduced from USD$102 billion to USD$31 billion, and our liabilities increased from USD$40 billion to USD$63.7 billion.

This was the disaster!…what this means is that he reversed everything……our DEBT TO EQUITY RATIO as a nation now became higher,……this was the reason that from 2012 when the debt started increasing, our credit ratings started dropping, FDI’s started reducing into Nigeria and were taking out their funds….though Nigeria’s external debt as at 2015 stood at about USD$10 billion, up from less than USD$4 billion Obasanjo had left it….the rest being internal debt…..the problem is that Nigeria does not have a structured system where government can raise taxes to pay these debts, hence the burden on the payment still much rests with government revenue from oil.

IS DEBT BAD????……..OBVIOUSLY NOT!……..But this is the difference, China has a Debt of USD$27 trillion (Liability) though over 90% in internal debt and an External reserve (Liquid Assets) of about USD$3 trillion, China has a DEBT TO EQUITY RATIO of 9 to 1, if we do not value its fixed assets……China’s borrowings (Liabilities) are being converted into fixed assets…..so when you eventually value the TOTAL ASSETS of China it might be greater than its Total Liabilities or a little below it. That is why China’s credit ratings has revolved around A-, A+, A2, A1, Aa3, AA-…..all graded by S&P, Fitch, and Moody’s…..you can see why investors are flooding to China.

SO how did GEJ and Okonjo-Iweala get away with it?…….it was simple!……..dollars flooded the market through both spending and corruption……which falsely created a healthy economy but with a bad balance sheet.

- All the Excess crude oil sales were diverted into private pockets that eventually ended up in the economy which would have given Nigeria between USD$30 billion to USD$40 billion.

- Depletion of the foreign reserve ended up in private pockets and flooded the economy…USD$31 billion.

- The emptying of the Excess cruse account…..USD$40 billion

- The borrowing of dollars was used for re-current expenditures (salaries and travels) and they also ended up in people’s pockets and flooded the economy……..USD$21.8 billion.

In essence the supply of the dollar was so much that it created stability for the demand in the economy even when the companies were mopping funds and leaving.

President Buhari and his many challenges!…………

The dangerous assumption is that if something makes sense (at least to the people proposing it) then everybody will fall in line and change their ways of doing things to conform with the new demands. Unfortunately, this seldom happens as easily as anticipated. People do not fall into line, sometimes because they just do not have the understanding and the skills required, and sometimes because they perceive, accurately or not, that the changes are not in their best interests….. From the book “Strategic Analysis and Actions”

What Buhari simply did was to open the books and show Nigerians the true reality of things…..the Jonathan administration only gave the illusion that all was well while things were going bad…..the credit ratings, limited inflow of FDI’s and massive withdrawals of dollars by companies are there to confirm this.

What Buhari is simply doing which many do not understand is the fact that he is restoring the three preliminary factors that encourage Foreign Direct Investments, namely?

- Stability (State and Regional).

- Increasing the Foreign Reserve to defend the Naira which will increase ROI for investors.

- And as Foreign Reserve is increased, it increases the assets base of the country and puts the country’s balance sheet back in green….

Without these factors in good conditions no foreign investors will want to come into the economy, those who feel the president don’t know what he is doing don’t really know how things work…..these are what he is doing and he is taking them one by one because they demand huge funding.

While oil companies were still operating in Nigeria and trying to break even with the new oil prices…..the Niger-Delta militants reduced the country’s capacity from 2.2m bpd to 1.4m bpd…..reducing Nigeria’s capacity by 800m bpd (36%)…..the implications of this is as oil prices fell, companies need more output to break even….so a company that is allocated 300,000 but can only pump 180,000 because of the reduced output might not be able to breakeven…..such company will not wait, they will move their funds to where they are able to make profits….as corruption fights back the economy suffers….the truth is we are our own worst enemies….money does not remain idle, it is always looking for where there are opportunities.

Buhari has been able to restore if not in total……about 95% order back to Borno State and the North East where Boko Haram held sway for years under Jonathan…..regional and state security is one of the main drivers of FDI’s. Buhari is massively investing in Infrastructure…..he has paid for most of the railway lines and construction is fully going on…and most of the funding to be paid for the projects under his administration to take off he has paid…..all with selling crude oil at less than $55 per barrel, output of 1.4 m bpd and he is still increasing the foreign reserve. The recently oversubscribed Euro bond show that investors’ confidence is returning to the market but all these will not happen overnight.

The United States Economy, Fracking, and Crude Imports!……

By end of 2016, the US trade deficit had reached USD$762.5 billion, Budget deficit had reached USD$590 billion and total debt was at USD$19.9 trillion. Without closing both trade and budget deficits, debt will continue to increase.

President Barack Obama inherited a USD$10.4 trillion debt, after he took office and had to fix the economy, the United States had to borrow massively and as at the end of 2016, the US debt stood at about USD$19.9 trillion.

Apart from borrowing to finance the wars and fixing the economy, the United States have been recording both trade and budget deficits for years. By end of 2016, the US trade deficit had reached USD$762.5 billion, Budget deficit had reached USD$590 billion, Without closing both trade and budget deficits, debt will continue to increase No sitting government likes to raise taxes…why?…..they become unpopular, so the only option is to keep borrowing and each time the government does that the debt increase.

According to the US Energy Information Administration, in the year 2000, fracking accounted for less than 2% of the United States oil production, by 2016 Fracking accounted for more than 50% of the United States oil output.

Prior to 2008, US multinationals had been investing in Hydraulic Fracturing Technology but yielding very little dividends and results, but all that was to change when technology started getting better paving the way to extract crude from huge shale deposits. According to the Energy Information Administration, in the year 2000, fracking accounted for less than 2% of the United States Internal oil consumption, by 2015 Fracking accounted for more than 50% of the United States oil output.

From just 23,000 fracking wells in year 2000 producing 102,000 barrels of oil per day, the US now has 300,000 fracking wells pumping out 4.3 million barrels per day……a whopping 3500% increase in output over 16 years……

By 2009 when the Obama administration took over the Whitehouse, government had to embark on a massive economic bailout to avoid a collapse of the economy, by this time fracking technology had started yielding positive results and the administration seeing the positive impact of reducing trade deficit through local oil production supported the industry with policies in 2013. By 2015, the US Senate also threw its weight behind the move by approving a measure to lift the 40-year ban on crude oil exports as part of a USD$1.1 trillion spending bill approved that will fund the US government until 2016.

From January 2009, oil output from Fracking continued to increase with a decline in net import, by September 2013, both Crude oil Net Imports and Production reached an equilibrium of 7.79 million barrel per day, and by May 2015, the United States Crude production had reached 9.69 million barrel per day and import reducing to 6.62 million barrel per day.

Recommendations………

We cannot continue to depend on oil…..the US output is now more than its import and for Nigeria to survive its economic challenges it must diversify its economy. Nigeria is a country to 180 million people with about 53% falling within the working age group, the country is a powerhouse. The country needs constant power to drive industrialization, we must make this the focus of this administration, for if the government does not put the population to use through productivity chaos could set in.

Oil Multinationals in the US are now pumping millions into research and development to better the processes and procedures of fracking to bring down the prices, the challenges ahead now is if crude from fracking is delivered at $50 to the International market tomorrow, we would be forced to reduce price to below $50…..what happens when Fracking delivers crude at $30 per barrel?….we must move away from crude if the economy has to survive.

Nigeria is a country of 180 million people with over 53%, over 90 million within the working age group, diversifying into massive manufacturing is the best way forward for Nigeria, and the country can supply the whole of Africa using its strategic location.

Government must have a strategic data management centre to that translate data to economic indices for government use to either support existing policies or change policies when data shows a different thing happening in the market.