With profit margins shrinking, American agriculture faces risk management challenges. One approach would be to make a priority of managing margin risk.

The boom of the commodity supercycle is over, at least as far as agricultural products are concerned. This is not really news, but it is worth considering its implications for risk and risk management, not just on the farm, but in the broader economy, as well.

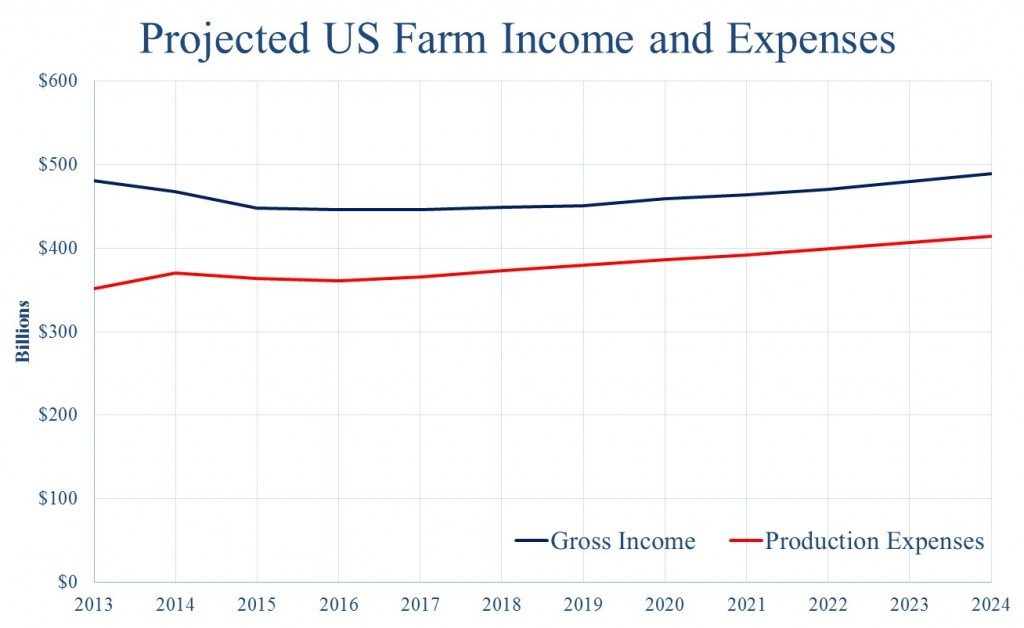

An Economic Research Service, United States Department of Agriculture, (ERS) report on long-term projections to 2024 was issued last month. At first glance, there does not seem to be much to worry about.

Demand for food is forecast to remain strong in the decade ahead. Agricultural commodity “prices will bottom out and then rise again, reflecting long-term growth in global demand for agricultural products,” according to ERS. “Longer run developments for global agriculture reflect steady world economic growth and continued global demand … which combine to support increases in consumption, trade, and prices of agricultural products.”

We would expect growing demand for agricultural products to raise prices, which implies an increase in costs. But strong demand is not expected to result in strong price increases. An additional problem is that agricultural production expenses are also forecast to rise. After a brief period of decline, “Farm production expenses…increase after 2016.”

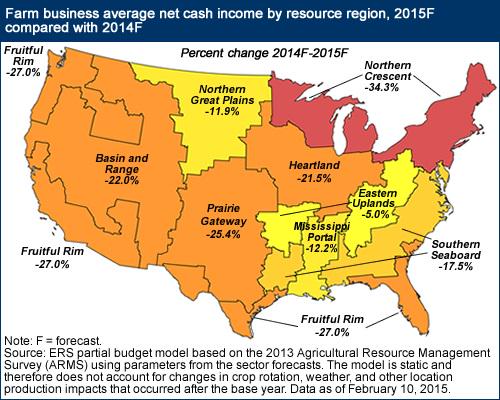

So here is the takeaway from the ERS report – expense growth is projected at an average annual rate of 1.14% versus 0.47% for income between 2014 and 2024. With expense growth looking to exceed revenue growth by 2.5 times between now and 2024, agribusiness faces a decade-long period in which profit margins are going to be squeezed. In the US alone, over $22 billion will be shaved from farm profits by 2024, a drop of nearly one-quarter from 2014.

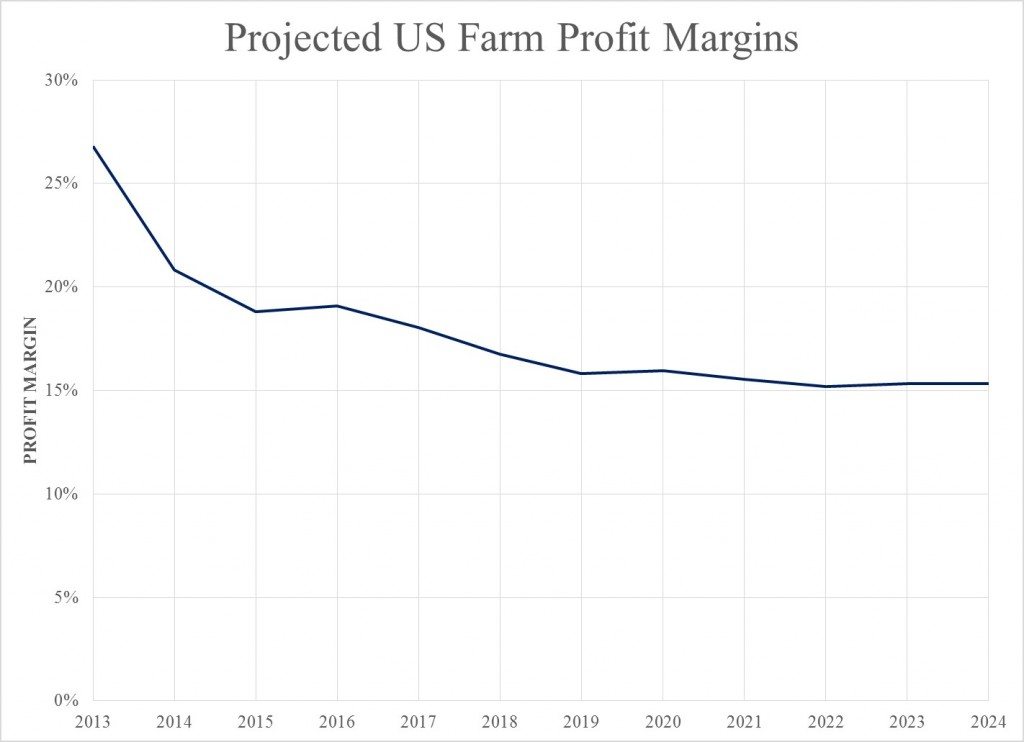

Narrowing margins is a perennial problem for agriculture. Farms are generally price takers on both the supply side and the demand side. If ERS projections hold, profit margins on American farms, defined as net income over gross income, are set to decline from 27% in 2013 to 15% over the next decade. Much of that decline has already occurred (see chart below), but an extended period of steadily, slowly contracting profits is not good news.

The prospect of a decade of shrinking margins calls for changes in agricultural operations and risk management. The typical practice in agribusiness is to focus on revenue stabilization and income risk management. Tools and strategies for managing volatility on the revenue side are much more commonly used than tools and strategies for managing cost instability. Cost-cutting measures will be needed to increase operational efficiencies and sustain margins.

Narrowing margins raises the likelihood that expenses will exceed revenues and that losses will ensue. In industries such as agriculture, where the relative bargaining power of suppliers and buyers squeezes producers from both sides, the need to protect profit margins and minimize the probability of loss is paramount.

Margin risk is more of an impediment to the continued success of the operation than the volatility of either revenues or expenses. Managing the farm operation’s margin risk by simultaneously tackling both revenue and cost volatility should be the strategic focus of agricultural risk management.

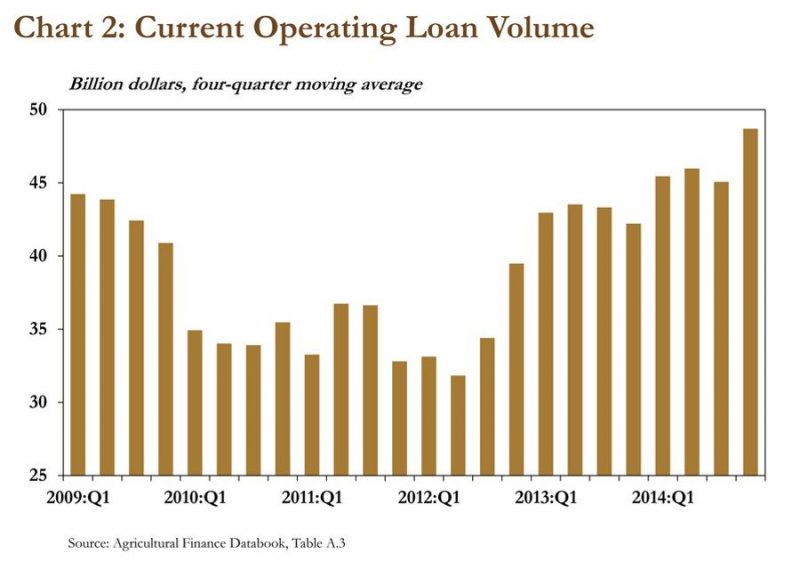

It cannot begin too soon. With spring planting in the US just around the corner, demand for operational loans should grow, just when interest rates are about to rise. An increase in interest expenses is of particular concern because it raises issues of growing credit risk. Farm operating loans were at a high in 2014 (see chart below).

Should the Federal Reserve raise rates this Spring, as it is expected to do, capital costs are bound to increase at a time when margins are coming under stress.

“The direction of farm sector profit margins in 2015 will be a key factor in determining whether agricultural credit conditions improve or worsen in the coming year,” says Nathan Kauffman, of the Federal Reserve Bank of Kansas City.

The end of the commodity supercycle, decreasing commodity prices, and increasing operating costs are challenges facing not just American agribusiness. Global trends are driving the economics of US agriculture, trends that will impact regions and lines of business beyond the US and its farm sector.

The end of the commodity supercycle, decreasing commodity prices, and increasing operating costs are challenges facing not just American agribusiness. Global trends are driving the economics of US agriculture, trends that will impact regions and lines of business beyond the US and its farm sector.

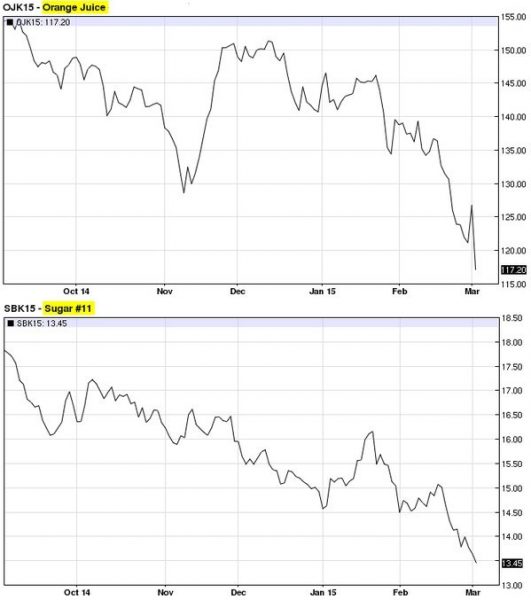

For example, Latin America faces the same dynamic. Institutional Investor looked into the region’s troubles resulting from the “commodities bust.” Falling agricultural prices (not to mention price declines for commodities in general) are creating risks for Argentina, Brazil, Chile, and Columbia. Take a look at what happened to orange juice and sugar futures this week due to Brazilian dumping of ag commodities in the face of a falling real:

Credit spreads are increasing to reflect these growing risks. Not only are economic and financial risks looming, but political risks, as well.

Credit spreads are increasing to reflect these growing risks. Not only are economic and financial risks looming, but political risks, as well.

II quotes Christopher Garman of the Eurasia Group. “We are seeing the end of a supercycle in politics as well as for commodities,” he says. The Mercosur countries – Argentina, Bolivia, Brazil, Paraguay, Uruguay, and Venezuela – are all facing protectionism, falling currencies, and rising unemployment.

The article cites several strategic approaches for Latin American countries to follow to manage these risks. Adam Kutas of the Fidelity Latin American Fund notes, “Managers are a lot more focused on cost cutting and higher returns on capital.” Alberto Ramos, a senior Latin American economist at Goldman Sachs argues, “There should be mechanisms to save the windfall from commodities exports during the good years and use the savings during bad years.”

Farm operations will have to be restructured to introduce greater efficiency. Technologies such as precision agriculture, drones, robotics, information management, and genetic engineering will play an important role in this. Increased competitiveness will shake out weaker operators – margins are already narrowing and the weakest players have the narrowest – that cannot make the transition.

Consolidation of some operators will occur. Those remaining will be well-positioned to manage operations effectively. Building up strategic cash reserves to help reduce credit risk and to get through times when cash or profits are short will also be an important risk management measure.

credit link http://globalriskinsights.com/2015/03/end-of-commodity-supercycle-puts-pressure-on-us-agriculture/