USA & CANADA (901)

Latest News

US election 2020: live count of the race to the White House and state-by-state breakdown of Senate races

Wednesday, 04 November 2020 11:46 Written by theconversationThe US has already seen record early voting in the presidential election, with more than 100 million people casting ballots before election day.

Now, the counting begins. With a variety of differences in when early votes and mail-in ballots can be tallied, as well as different closure times for polling places, the results will trickle in throughout the day (and evening).

We’ll be regularly updating this article as data becomes available and relying on The Associated Press to call individual state races.

There are plenty of other races being contested around the country, including, most importantly, the Senate. More than a third of the Senate seats (35 out of 100) are being contested — and the Democrats have a good chance of taking back control from the Republicans.

Of the 35 seats, the Republicans are defending 23 and the Democrats 12. The Democrats need a net gain of three seats to control the Senate if Joe Biden wins the presidency, and a net gain of four seats if Donald Trump is re-elected.

![]()

Wes Mountain, Multimedia Editor, The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.

U.S. election results may suggest ethics no longer matter ... just like in Canada

Wednesday, 04 November 2020 11:45 Written by theconversation

Ako Ufodike, York University, Canada

During Donald Trump’s first term, there have been a record 30 congressional, criminal or state investigations into his affairs, compared to four for his predecessor, Barack Obama, over his two terms.

It’s impossible to dismiss all of these investigations as political witch-hunts. In fact, when Trump took office in 2016, only 33 per cent of Americans believed that he was honest — a number that has remained consistent. Ironically, the president to whom Trump has most often compared himself is “Honest Abe” Lincoln, likely because of his assumption that honesty matters to voters.

But does it?

While the outcome of the U.S. election may not be known for days, one thing is clear — Trump outperformed pollster predictions once again in 2020.

Conventionally, voters enforce political accountability. But Trump won the 2016 election without being perceived as honest or trustworthy, and the Republican Party actually attained its most favourable rating since 2005 in January 2020 when the Republican-led Senate acquitted the recently impeached Trump.

That raises questions about whether ethics still matter in politics. Do voters have an increasing tolerance for political misconduct or do they just have other electoral priorities?

Canada not immune

As Canadians, we like to think our politics are somehow less tainted or controversial than American politics, but these questions resonate equally in Canada.

Prime Minister Justin Trudeau was investigated three times between 2015 and 2019 for various ethical misconduct related to the SNC-Lavalin affair and his vacation visits to the Aga Khan’s private island.

Read more: The SNC-Lavalin affair and the politics of prosecution

Canada’s ethics commissioner found Trudeau guilty of contravening conflict-of-interest laws in both cases. Trudeau’s predecessor, Stephen Harper, faced no investigations during his eight years in office. Clearly, it’s appropriate to wonder about the diminishing role of ethics in our choice of national leaders in Canada as well.

But let’s look back to November 2019 in the United States for a moment: Trump wanted to avoid the public spectacle of impeachment proceedings because of concerns about their impact on public perception.

The administration actively sought to block the testimony of anyone with first-hand knowledge of the events, and Trump’s legal team claimed immunity for all top presidential aides.

It seems that Trump was unnecessarily worried about public perception. In the November and December Gallup polls before he was impeached on Dec. 19, 2019, Trump’s average approval was 44 per cent. In the two polls following impeachment, his average approval rating increased to 47 per cent, and in two more polls after the Senate acquittal, his approval held steady at 46 per cent.

What does matter to voters?

If ethics don’t matter in the choice of political leaders anymore, what does? According to a recent Gallup poll, the most important issue in the 2020 U.S. election was health care. Unsurprisingly, voters also identified the economy as one of the top five issues in the election. Health care, the economy and education are the only common three of the top five issues in both the 2016 and 2020 elections.

The COVID-19 pandemic have exacerbated concerns over health care, sending it from third place in 2016 to first place in 2020 — and that was the largest hurdle for Trump’s campaign this year, not the public’s perception of his ethics or honesty.

Canadians likewise identified health care and the economy as top concerns in both the 2019 and 2015 federal elections. During the last election in 2019, voters cited the cost of living, health care and climate change as three of the top five issues.

Accountability has gone from being a top concern for 11.4 per cent of respondents ahead of the Canadian 2011 election to 7.1 per cent in 2015 and six per cent in the 2019 election in spite of the SNC-Lavalin investigations.

Trudeau’s re-election

Like Trump’s concerns about impeachment, Trudeau’s concerns about the electoral costs of the SNC-Lavalin affair were unfounded. Furthermore, Trudeau is notably the first and only Canadian prime minister to break a federal conflict-of-interest statute in relation to his Aga Khan trips — and yet he got re-elected to a second term, albeit with a minority government.

As the SNC-Lavalin affair showed, Trudeau, like Trump, prefers that certain details of his dealings not be played out in public.

The office of the Ethics Commissioner, in its investigation of Trudeau’s conduct related to SNC-Lavalin, reported that the government denied it access to cabinet confidences, suppressed witness testimony and therefore prevented the office “from looking over the entire body of evidence.”

Despite the government’s efforts to limit the scope of the investigation, the commissioner concluded that Trudeau contravened Section 9 of Conflict of Interest Act.

More recently, the WE Charity investigation, which kicked off Trudeau’s fifth year as prime minister, has superseded the SNC-Lavalin affair.

Read more: Why Trudeau’s self-serving prorogation of Parliament should be Canada’s last

Do Canadians care about ethics?

How will Canadians rank ethics and accountability in the next election? Will we care about the ethics laws that our leaders have violated, or, like in the United States, will the pandemic amplify concerns over health care and economic recovery, overshadowing ethics?

If the 2020 U.S. election is any indication, focusing on the economy and health care, rather than past or present ethics investigations, will resonate more broadly with voters. For Canadian politicians, environmental policies and platforms will be a close third.

Unethical politicians may be off the hook for bad behaviour as voters prove again that they’re willing to look the other way.![]()

Ako Ufodike, Assistant Professor, York University, Canada

This article is republished from The Conversation under a Creative Commons license. Read the original article.

This Halloween, witches are casting spells to defeat Trump and #WitchTheVote in the U.S. election

Tuesday, 03 November 2020 04:44 Written by theconversation

Jessalynn Keller, University of Calgary and Alora Paulsen Mulvey, University of Calgary

This Halloween, the witches are coming — to the ballot box.

Using the hashtag #WitchTheVote, witch-identified folks are encouraging others who have an interest in the occult to get informed about political candidates and cast their vote in the U.S. presidential election Nov. 3.

Originally launched by a group of witches from Salem, Mass., during the lead-up to the 2018 midterm elections, #WitchTheVote is a cross-media initiative that identifies and promotes — as one witch tells us — “witch-worthy” political candidates: those who are progressive and social justice oriented. It’s fitting political activism in a town known for the Salem witch trials and contemporary witch tourism.

Witching movements

More than a hashtag, #WitchTheVote is also, according to the group, a “collective intersectional effort to direct our magic towards electing candidates who will push our country and our planet forward into the witch utopia we all envision.”

Here, intersectional feminist politics work alongside magic and creative media production to engage in political activism that includes advocacy around issues like affordable housing, reproductive rights and #BlackLivesMatter. #WitchTheVote runs a regular podcast and has also made and distributed zines with information for prospective voters, including how to register to vote and how to check to ensure your mail-in ballot was received.

This collective effort illustrates the ways in which “magical resistance” has become a popular, women-led form of mediated, political activism since the election of Donald Trump in 2016.

The resurgence of the witch

#WitchTheVote is situated within a resurgence of witches in popular culture over the past four years. Between Netflix’s teen drama The Chilling Adventures of Sabrina, beauty retailer Sephora’s Starter Witch Kit (which was eventually removed due to backlash), the revival of the cult classics teen witch movie The Craft and TikTok spell trends, the witch is having a cultural moment.

Read more: Dressed to kill: 6 ways horror folklore is fashioned in the movies

Books such as Pam Grossman’s Waking the Witch (2019) have attracted widespread media attention, while public interest in astrology and tarot readings has also grown.

Esthetically, witchcraft and mysticism circulate easily on visual social media platforms such as Instagram and TikTok, where colourful crystals and elaborate altars make for beautiful photos and videos. From a branding perspective, the witch’s popularity makes sense within a larger cultural interest in spirituality, wellness and mysticism.

But there is also a case to be made for the very political nature of the witch. The archetype of the witch has a historical relationship with feminist activism. As an unruly figure and threat to the patriarchy, the witch is resistant, and has been used in feminist protest since the 1960s.

Read more: Sirens, hags and rebels: Halloween witches draw on the history of women’s power

At a moment of regressive politics marked by a resurgence of white supremacy, xenophobia and anti-feminist sentiments, coupled with the uncertainty of a global pandemic and the looming climate crisis, it is unsurprising that women and other marginalized folks are turning to witchcraft as a way to make sense of — and act upon — our current political, social and economic milieu.

The digital coven

It is perhaps the collectivist sentiment of contemporary witchcraft — belonging to something bigger, together — that is appealing. Indeed, #WitchTheVote’s mandate as a “collective intersectional effort” suggests the force of doing something together, yet attuned to the different experiences, including those related to race, class, sexuality, age and ability, that participants may face.

And while not the only tool for mobilizing a collective, technology has become a significant connector for covens in recent years. Social media platforms, in particular, provide what some witches refer to as “globally accessible magic.”

By embracing technology while recognizing its limitations and inherent oppressions, witches are engaging in new rituals with the intent of keeping their channels clear for maximum revolutionary power on an individual and collective level.

For example, upon Donald Trump’s election in 2016, witches began a monthly ritual of casting a spell to “bind” Trump, preventing him from pursuing his agenda that many witches believe to be harmful. Some witches used platforms such as Facebook Messenger and Twitter to connect with other spell-casting witches at a designated time each month, ensuring that the “mass energy of the participants” is harnessed.

Spells and rites

Historically, spells often required very little in terms of commercial goods. Instead, witches relied on basic household items like candles and feminized rituals such as sweeping to engage in witchcraft. #WitchTheVote’s “A Multi-tasking Spell for Mutual Aid During COVID-19” lists a pen, paper and “anything else that makes you feel like a witch” as necessary materials. Other spells recommend candles of any size and colour and dirt from your backyard.

The emphasis is not on the materials themselves, but instead engaging with rituals that help witches feel empowered through practices that provide a sense of routine, stability and purpose in unpredictable times.

In the digital age, using the Internet as another avenue to practice witchcraft seems like a natural extension to the tradition of making do with the resources available to you. We may even think of emojis, shares, likes and retweets as possible technologies of magic when used with energetic intention to manifest social change.

And these practices are extensions of activist use of technologies such as feminist listservs, e-zines, chatrooms, homepages, feminist blogs and now, social media.

Casting spells and votes

In a political, cultural and economic moment in which many people feel a sense of hopelessness about the future, #WitchTheVote encourages activists to ground themselves through ritual and magical resistance.

They remind us of girls’ and women’s lengthy history in subverting repressive politics through focused collective action. In casting their votes along with their digital coven on Nov. 3, Salem’s activist witches hope to #WitchTheVote, one ballot at a time.

Jessalynn Keller, Associate Professor in Critical Media Studies, University of Calgary and Alora Paulsen Mulvey, PhD Student, Department of Communication, Media and Film, University of Calgary

This article is republished from The Conversation under a Creative Commons license. Read the original article.

US forces rescue American citizen abducted in Niger Republic and held hostage in Nigeria

Saturday, 31 October 2020 15:28 Written by OASESNEWSUS forces on Saturday October 31, rescued an American citizen taken hostage by armed men earlier this week in Niger and held in the northern part of the country.

The mission was undertaken by elite commandos as part of a major effort to free the U.S. citizen, Philip Walton, 27, before his abductors could get far after taking him captive in Niger on October 26, counterterrorism officials told ABC News.

Pentagon spokesman Jonathan Hoffman said in a statement;

"U.S. forces conducted a hostage rescue operation during the early hours of 31 October in Northern Nigeria to recover an American citizen held hostage by a group of armed men. This American citizen is safe and is now in the care of the U.S. Department of State. No U.S military personnel were injured during the operation.

"We appreciate the support of our international partners in conducting this operation. The United States will continue to protect our people and our interests anywhere in the world."

The operation involved the governments of the U.S., Niger and Nigeria working together to rescue Walton quickly, sources said. The CIA provided intelligence leading to Walton's whereabouts and Marine Special Operations elements in Africa helped locate him, a former U.S. official said.

U.S. and Nigerien officials had said that Walton was kidnapped from his backyard last Monday after assailants asked him for money. But he only offered $40 USD and was then taken away by force, according to sources in Niger. Walton lives with his wife and young daughter on a farm near Massalata, a small village close to the border with Nigeria.

The US forces who conducted the mission killed six of the seven captors, the official said. The US believes the captors have no known affiliation with any terror groups operating in the region, and were more likely bandits seeking money.

US Secretary of State Mike Pompeo who also commented on the rescue mission, said the US citizen would be reunited with his family.

Pompeo said;

"Thanks to the extraordinary courage and capabilities of our military, the support of our intelligence professionals, and our diplomatic efforts, the hostage will be reunited with his family. We will never abandon any American taken hostage."

Popular News

Whether it's for Trump or Biden, Americans who trust others are more likely to vote

Saturday, 31 October 2020 14:40 Written by theconversationForecasting election results is hard. Predicting who will turn out to vote next week in the United States is not.

The rich are more likely to vote than the poor. The better educated are more likely to vote than the less educated. White people are more likely to vote than racialized Americans.

As a scholar who has studied trust and how it matters for years, I can say that generalized trust — an expectation of good will and benign intent of others — is also a powerful predictor of voter turnout.

Whomever they vote for, Americans who are trusting are more likely to have either cast their ballots already or will on election day than Americans who do not trust easily.

Trust inequality can explain disparity in voter turnout. My research shows that, regionally across the United States, trust is lower in the South, and Southerners are less likely to vote. I also show that those who feel they have less power in society are less able to trust. This can, at least partly, explain why the poor and racialized Americans are less likely to vote.

The promise of democracy in part rests on citizens being able to trust equally.

Post-election data

My study of elections relies largely on turnout data from post-election surveys. Two major ongoing surveys that document voter turnout in the U.S. are the American National Election Studies (ANES) and the U.S. General Social Survey (GSS).

Since 1948, the ANES has asked respondents after each presidential election whether they voted. The mission of the ANES data is to provide high-quality data to help researchers understand “why does America vote as it does on election day.”

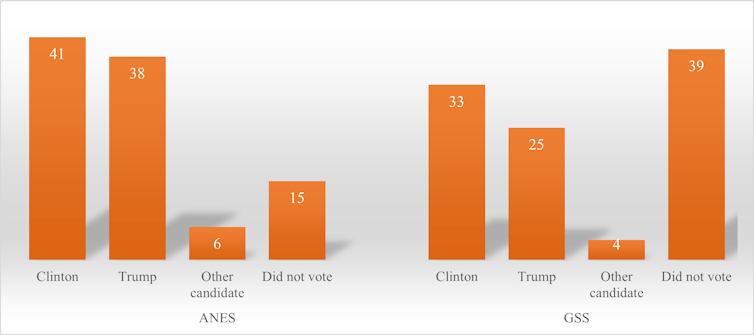

The GSS has interviewed American citizens — annually from 1972 to 1993 and biannually since 1994 — to ask similarly whether they voted in presidential elections. See the turnout information from the 2016 presidential below:

Data from the U.S. Census Bureau shows that 61.4 per cent of the voting-age population reported voting in the 2016 presidential election. In comparison to this number, the graph above shows the ANES significantly overestimated voter turnout at 85 per cent.

That’s not unusual. Post-election surveys often overestimate voter turnout due to reasons that include social desirability response bias (the tendency of survey respondents to answer questions in a manner that will be viewed favourably by others), recall errors (the gap grows as more time passes between the election and the survey interview) and biased non-response (people who do not vote are especially unlikely to participate in surveys).

Nonetheless, these post-election surveys are useful for studying, for example, how race, gender and socioeconomic class might shape voting behaviour, so I’ve included data from both surveys in my research.

Trusting Americans are more likely to vote

Previous research has also suggested that trust plays an important role in political participation. Voting is a typical form of political participation. That means we would expect voter turnout to be higher among Americans who trust than those who do not trust easily.

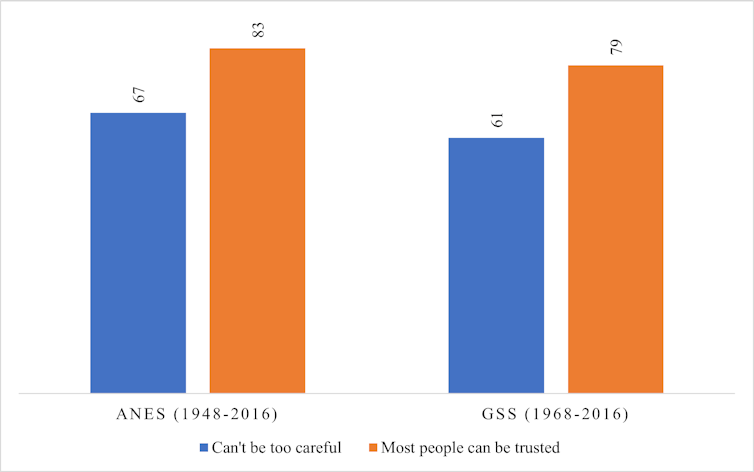

In many surveys, the widely used statement to measure overall trust is: “Generally speaking, would you say that most people can be trusted or that you cannot be too careful in life?” This statement was part of both the the ANES and the GSS surveys.

My analysis of the data from both surveys shows that Americans who think “most people can be trusted” are much more likely to vote than those who think “cannot be too careful in life.” The pattern is also highly consistent when I separate the analysis on a yearly basis. Higher trust is associated with a higher turnout in every U.S. presidential election since 1948.

Taking into account race, gender, age, level of education and household income, as well as the year of the election, Americans who trust are about 70 per cent more likely to vote than those who do not trust, regardless of which survey we use (72 per cent from ANES; 70 per cent from GSS).

Trust impacts Republicans more than Democrats

But does trust affect Republican voters and Democrat voters differently?

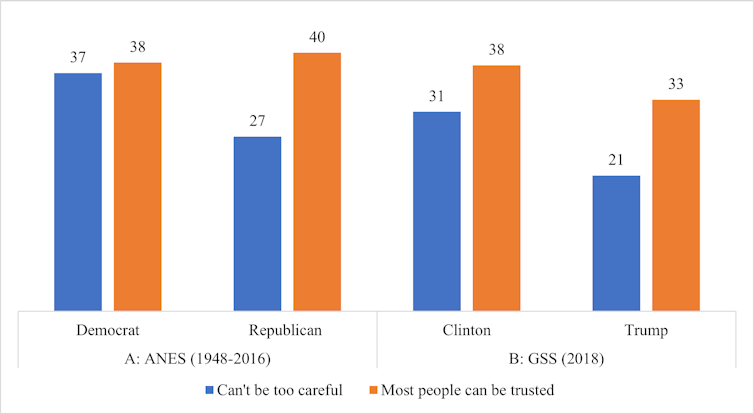

To answer this question, I compare turnout gaps between “trusters” and “mistrusters” among Republican voters and Democrat voters.

The graph below shows that overall the voting gap between trusters and mistrusters is greater among those who vote Republican than those who vote Democrat. Specifically, based on the cumulative data from the ANES (1948-2016), the left side of the graph shows that while the voting gap between trusters and mistrusters is only about one percentage point (38 per cent versus 37 per cent) for Democratic voters, the gap is 13 percentage points for Republican voters (40 per cent versus 27 per cent).

The right side of the graph focuses on the 2016 election only using data from the 2018 GSS. It shows that while the voting gap between trusters and mistrusters was seven percentage points among Clinton voters, the gap was 12 percentage points among Trump voters.

These findings suggest trust has a greater impact on Republican voters than those who vote Democrat.

Why are minorities less likely to vote?

Racialized Americans are often found to have a low voter turnout. The Pew Research Center has reported that the turnout rate in the 2016 presidential election was 65.3 per cent among white registered voters, 59.6 per cent among Blacks, 49.3 per cent among Asians and 47.6 per cent among Hispanics.

Common explanations for why minorities are less likely to vote include voter suppression and systematic discrimination. However, in his recent book The Turnout Gap, political scientist Bernard Fraga has argued instead it’s the sense of political inequality that largely explains the majority-minority gap in turnout.

Turnout gaps

Trust is associated with control, political efficacy and sense of political empowerment. Can minorities’ lower trust explain their lower turnout?

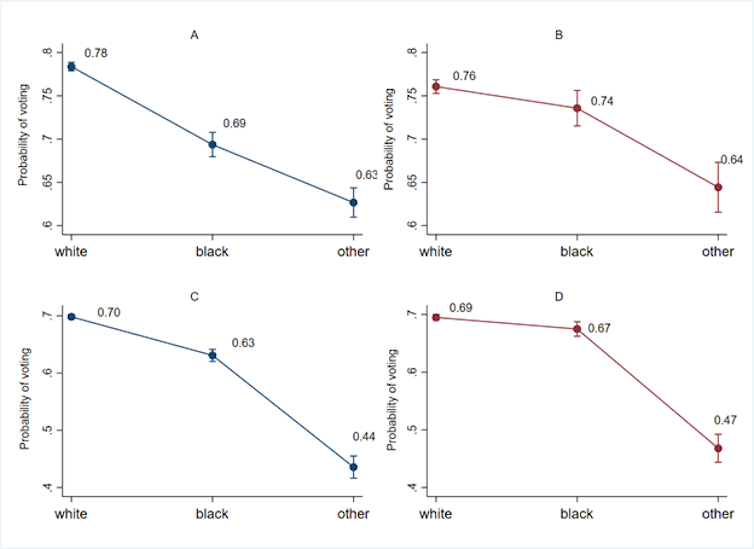

To show how trust can help explain the turnout gap across racial groups, I estimate the average probability of voting for white people, Black people and other racialized Americans using data from both surveys. The base model includes race and year variables, while the second model adds a trust variable to the base model. Here’s a visualization:

Graph A shows that the average turnout rate among white voters over an 18-year span is 78 per cent, 69 per cent among Black voters and 63 per cent among other racialized Americans.

When taking into account the trust differences among these groups, these numbers become 76 per cent, 74 per cent and 64 per cent respectively (Graph B). In other words, the relative gaps in turnout have become significantly smaller. For example, the gap between white voters and Black voters in Graph A is nine percentage points, but after controlling for trust, it’s only a relatively insignificant two percentage points. These findings are based on the ANES data.

Replicating the analysis using data from the GSS shows a consistent pattern. See Graphs C and D.

What does this show us in broader terms?

Democracy only works well when citizens participate in the democratic process and participate equally. But in the United States, lack of trust is eroding democracy’s promise.![]()

Cary Wu, Assistant Professor, Department of Sociology, York University, Canada

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Canada extends ban on international travelers

Saturday, 31 October 2020 13:03 Written by dailypostCanada has extended its restriction on non-essential international entries until the end of November as Coronavirus cases continue to rise.

The North American nation has, however, eased quarantine rules for some cut-off Canada-US border communities.

The travel ban has been in force since mid-March, while Ottawa and Washington have a separate arrangement prohibiting non-essential travel between their two countries set to expire one week earlier.

Travellers allowed into Canada despite the ban must still quarantine for 14 days upon arrival.

But Public Safety Minister Bill Blair on Friday said, “some practical adjustments” to the rule would be made to allow residents of a few outlier communities, to cross the border to access necessities such as food and medical care without having to self-isolate after each trip.

He specifically listed Campobello Island in New Brunswick; Stewart, British Columbia; Northwest Angle, Minnesota; and Hyder, Alaska – all cut off from their respective countries due to border irregularities, such as panhandles.

The government will also allow exemptions for a pilot project with the province of Alberta on alternatives to quarantines.

Slavery charges against Canadian mining company settled on the sly

Friday, 30 October 2020 05:11 Written by theconversation

Elizabeth Steyn, Western University

Mining is major business in Canada, particularly operations conducted beyond its borders. The Canadian mining industry, however, has often been criticized for its human rights record abroad.

In 2018, Canadian companies had mining assets in 100 countries abroad, valued at $174.4 billion. This made up two-thirds of total Canadian mining assets.

Among the 100 countries was Eritrea, where the operations of the gold, copper and zinc Bisha mine gave rise to one of the most closely observed pieces of litigation in Canada in recent years, largely because it involved allegations of slave labour and torture. Its recent settlement in near total silence therefore raises some important questions.

Alleged human rights abuses

First, though, it’s important to understand what happened in the case. In 2014, three Eritrean plaintiffs launched a class-action lawsuit in the British Columbia Supreme Court against a Vancouver-based mining company, Nevsun Resources.

They alleged that they had suffered human rights abuses at the Bisha mine, including slavery and torture, as well as a variety of domestic violations, including assault, battery and unlawful confinement. The mine was held by a consortium comprising Nevsun and the Eritrean government.

The claimants said they were part of Eritrea’s involuntary and indefinite military conscripts and deployed to work at the mine for subsistence wages. When they tried to flee, they were allegedly beaten with sticks, tied up and left to lie in the hot sand in temperatures of up to 50 C.

Under provincial court rules, a defendant may request early on that a matter be removed from the court’s roll, arguing essentially that the claim has no reasonable chance of succeeding. Nevsun made this request.

At the end of February 2020, the Supreme Court of Canada upheld the decisions of the British Columbia Supreme Court and the B.C. Court of Appeal, refusing the defendant’s request. Justice Rosalie Abella concluded:

“Customary international law is part of Canadian law. Nevsun is a company bound by Canadian law. It is not ‘plain and obvious’ to me that the Eritrean workers’ claims against Nevsun based on breaches of customary international law cannot succeed.”

This opened the way for the matter to proceed to trial. It had the potential to set a major precedent in terms of the liability of Canadian mining companies for wrongs committed abroad.

Québec case

Attempts to hold Canadian mining companies accountable for the human rights abuses or environmental disasters of their subsidiaries abroad date back to a 1998 Québec case, Recherches Internationales Québec (RIQ) vs. Cambior Inc. In this case, toxic waste water had spilled into Guyana’s main river, the Essequibo, after the failure of Omai gold mine’s waste treatment dam.

As primary shareholder of Omai, Cambior had both financed and supervised the mining project. The Québec Superior Court ruled that a Guyanese court should hear the matter. But the 23,000 Guyanese victims did not succeed in the High Court of Guyana, though they tried twice.

The recent settlement of Nevsun vs. Araya didn’t make very much news in the Canadian media. The Franco-African press reported that a terse news release had invoked confidentiality, indicating that the parties had reached a “mutually satisfactory arrangement.” This means that the litigation came to an abrupt end.

One can’t blame the Eritrean plaintiffs for wanting to end the matter. It’s also understandable that the company wished to avoid the increased media attention that court cases bring. The mining industry undoubtedly will breathe a sigh of relief.

Kept quiet

The disturbing aspect of this settlement is that it has been kept so quiet. It ends a high-profile case with an elevated potential for setting negative precedents for Canadian mining companies operating abroad. Contrast this with the settlement terms of another matter involving allegations of human rights abuses, Garcia vs. Tahoe Resources, Inc.

In that case, the B.C. Court of Appeal had cleared the way for a trial against Tahoe Resources, which, through its wholly owned subsidiaries, fully controlled the operations of the Escobal mine in Guatemala.

The mine’s security guards had fired on protesters, leading to criminal charges against the mine’s head of security in Guatemala. The protesters launched a battery claim against Tahoe in Canada. The B.C. Court of Appeal allowed the matter to proceed in Canada, based on the risk of unfairness for the claimants in Guatemalan courts due to systemic corruption.

Tahoe was then acquired by Pan American Silver, which went on to settle the matter publicly. Terms of settlement included acknowledging wrongdoing and condemning the use of violence, apologizing to the victims and the community and reiterating the rights of the victims to protest against the mine in future. It was a win for the mining industry because harms had been redressed in a way that brought greater transparency.

Nevsun, too, was acquired by another company, Zijin Mining, prior to the settlement. But the similarities end there.

Make no mistake. I am not opposed to the Nevsun settlement. Settling matters avoids extensive litigation and high legal costs.

But what’s troublesome is the veil of secrecy in which this settlement is cloaked. Greater transparency, while not legally required, would have demonstrated that Nevsun is a responsible mining company that takes the interests of its stakeholders seriously. Instead, Nevsun remains silent.![]()

Elizabeth Steyn, Cassels Brock Fellow and Assistant Professor of Mining and Finance Law; Public and Private International Law Research Group Member, Western University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Canada’s woeful track record on children set to get worse with COVID-19 pandemic

Thursday, 29 October 2020 05:26 Written by theconversation

Neil Price, University of Toronto and Emis Akbari, University of Toronto

The recent UNICEF report card exposes Canada for failing its young children. The report, appropriately called “World’s Apart,” examines the status of children from the world’s most developed countries and looks at child happiness, well-being and skill. Among 38 developed economies, Canada falls 30th overall.

Unfortunately, the report highlights a recurring issue in Canada. It is one of many reports over the past two decades that demonstrate the inequities faced by many Canadian children.

How can Canada with its relatively positive environmental, social and economic conditions, fall so drastically behind the United Nations’ most recent targets for a sustainable world?

Risks to physical and mental well-being like poverty, systemic racism, pollution, climate change and uneven access to early education, all endanger opportunities for growth and development. According to the report, these dangers are far too widespread.

Canada’s inequity gaps are wide, child poverty is rampant and national averages gloss over worse conditions for those from racialized communities and Indigenous children. The report reveals that although the average child poverty rate in Canada is one in five, children from Black communities have rates as high as one in three. Within some Indigenous communities it’s a staggering one in two.

Something that should put all Canadians on alert is that this report provides a picture of the status of Canadian children prior to the COVID-19 pandemic. This pandemic brings with it new pressures and threats to child health and well-being.

The inequity gaps will likely grow.

Read more: Coronavirus school closures could widen inequities for our youngest students

Anti-racist uprisings add urgency

The UNICEF report arrives at a time of immense global protest spurred in part by the disproportionate impacts COVID-19 has had on racialized communities.

Entrenched racism and ongoing police brutality are issues that compound the conditions that children live within. We feel a growing impatience with reports that repeatedly illustrate the enormous challenges that children face but offer few concrete solutions.

In its report, UNICEF recommends policy-makers and communities “be accountable,” “be bold” and “listen to children and youth.” However, the report fails to take into account all the ways in which Black and Indigenous communities in Canada have been historically and systematically prevented from taking up such encouragements.

There is little acknowledgement of how racialized communities have been marginalized through the denial of resources and involvement in policy development. This is often the case with such reports.

COVID-19

Black and Indigenous children have been disproportionately harmed by the pandemic, so it should be clear that equity-focused approaches are required.

Yet most reports fail to emphasize culturally appropriate responses as an essential criteria for improving the well-being of children. We see no evidence of concerted efforts among Canadian policy-makers to use disaggregated race-based data to propose programs and funding mechanisms to help the most vulnerable.

How policy-makers and government bodies respond will determine the outcome for Canadian children, especially those within marginalized communities. Specific and customized responses to barriers in education, health and well-being are critically important as we move through and beyond COVID-19.

However, local and federal governments have been prioritizing resuscitation of the economy over addressing the social impacts of the pandemic. As a result, Black and Indigenous children are poised to slide further down health indices unless concrete and urgent steps are taken to address their unique circumstances. To begin to rectify Canada’s long-standing inaction towards the well-being of Black and Indigenous Peoples, policy-makers must act now.

Barriers to ‘bold action’

Funding discrepancies between non-Indigenous and Indigenous children must end. Governments must ensure that all children, regardless of their economic status, indigeneity, parent employment, race and ethnicity, have equal opportunities. This requires equitable policies.

We recommend a move toward action-based, participatory approaches to research and policy that offer concrete proposals for policy development that target the deeply entrenched inequities that form Canada’s social and economic foundation.

Policies need to be integrated with systems of education and health that have unique and important roles towards reconciliation.

Strong, focused and equitable policies to support children are needed now more than ever. Now that we have seen decades of consistent evidence of inequity and poverty, Canadian policy makers should not need to see another report. They need to take action. Canada’s children deserve better. They need federal efforts to rectify the obvious opportunity gaps. Canada’s track record leaves out too many: it needs to do better. Not tomorrow, today.![]()

Neil Price, PhD student, Adult Education and Community Development, University of Toronto and Emis Akbari, Adjunct Professor, Department of Applied Psychology and Human Development at Ontario Institute for the Study of Education (OISE), University of Toronto

This article is republished from The Conversation under a Creative Commons license. Read the original article.